Once you prepare your information, generate your COGS journal entry. Calculate COGSĬOGS = Beginning inventory + purchases during the period – ending inventory 3. Collect information ahead of time, such as your beginning inventory balance, purchased inventory costs, overhead costs (e.g., delivery fees), and ending inventory count. Gather information from your books before recording your COGS journal entries.

#Cogs journal entry how to#

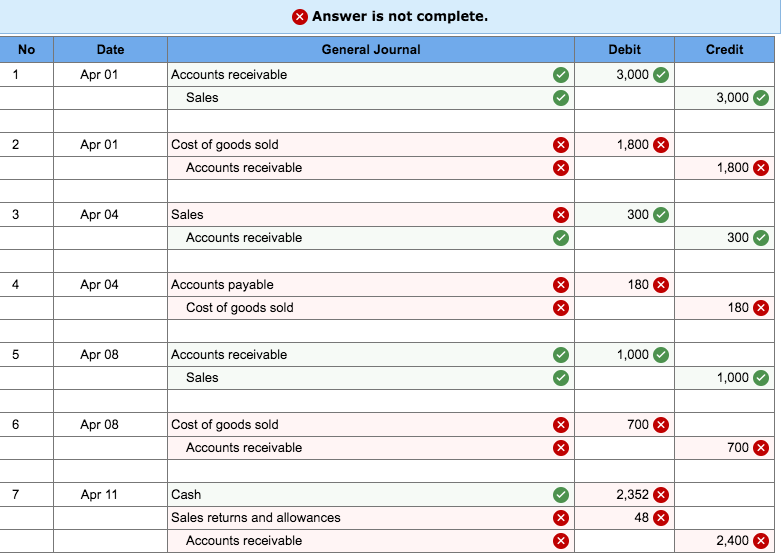

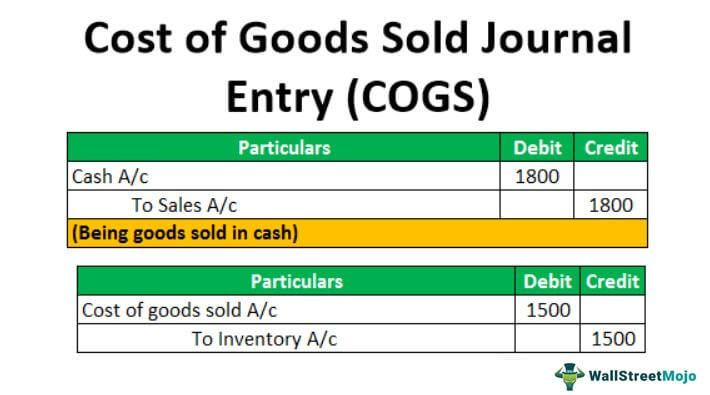

How to record cost of goods sold journal entryįollow the steps below to record COGS as a journal entry: Knowing your business’s COGS helps you determine your company’s bottom line and calculate net profit. Gross profit shows you how much you are spending on COGS. It also shows your business’s sales, expenses, and net income.Īlong with being on oh-so important financial documents, you can subtract COGS from your business’s revenue to get your gross profit. This financial statement reports your profit and losses. Your income statement includes your business’s cost of goods sold. Get My Free Guide! Why is COGS important? Your COGS calculation would look like this: Let’s say your business’s beginning inventory is $2,000 and you purchase $500 of supplies during the period. Follow the formula below to calculate your COGS:ĬOGS = Beginning inventory + purchases during the period – ending inventory Example of calculating COGS Calculating COGSīefore you can jump into learning about recording cost of goods sold journal entry, you need to know how to calculate COGS. If you don’t account for your cost of goods sold, your books and financial statements will be inaccurate. That’s where COGS accounting comes into play. It’s important to know how to record COGS in your books to accurately calculate profits. When is cost of goods sold recorded? You only record COGS at the end of an accounting period to show inventory sold. Simply put, COGS accounting is recording journal entries for cost of goods sold in your books.

#Cogs journal entry plus#

COGS is your beginning inventory plus purchases during the period, minus your ending inventory. But do you know how to record a cost of goods sold journal entry in your books? Get the 411 on how to record a COGS journal entry in your books (including a few how-to examples!).Īs a brief refresher, your COGS is how much it costs to produce your goods or services. For more information about Oracle (NYSE:ORCL), visit a business owner, you may know the definition of cost of goods sold (COGS). Oracle offers a comprehensive and fully integrated stack of cloud applications and platform services. My Oracle Support provides customers with access to over a million knowledge articles and a vibrant support community of peers and Oracle experts.

#Cogs journal entry full#

To view full details, sign in with your My Oracle Support account.ĭon't have a My Oracle Support account? Click to get started! The COGS entries are not getting created nor transferring to GL. Item has been shipped for the sales order, we ran the below three reports Why are we unable to see the Cost of Goods Sold (COGS) entries in General Ledger or Material Distributions? Information in this document applies to any platform. Oracle Cost Management - Version 12.1.1 and later How To Generate COGS Entries For Material Distribution And Passing To General Ledger?

0 kommentar(er)

0 kommentar(er)